| StockFetcher Forums · General Discussion · XIV | << 1 ... 14 15 16 17 18 ... 22 >>Post Follow-up |

| pthomas215 1,251 posts msg #141811 - Ignore pthomas215 |

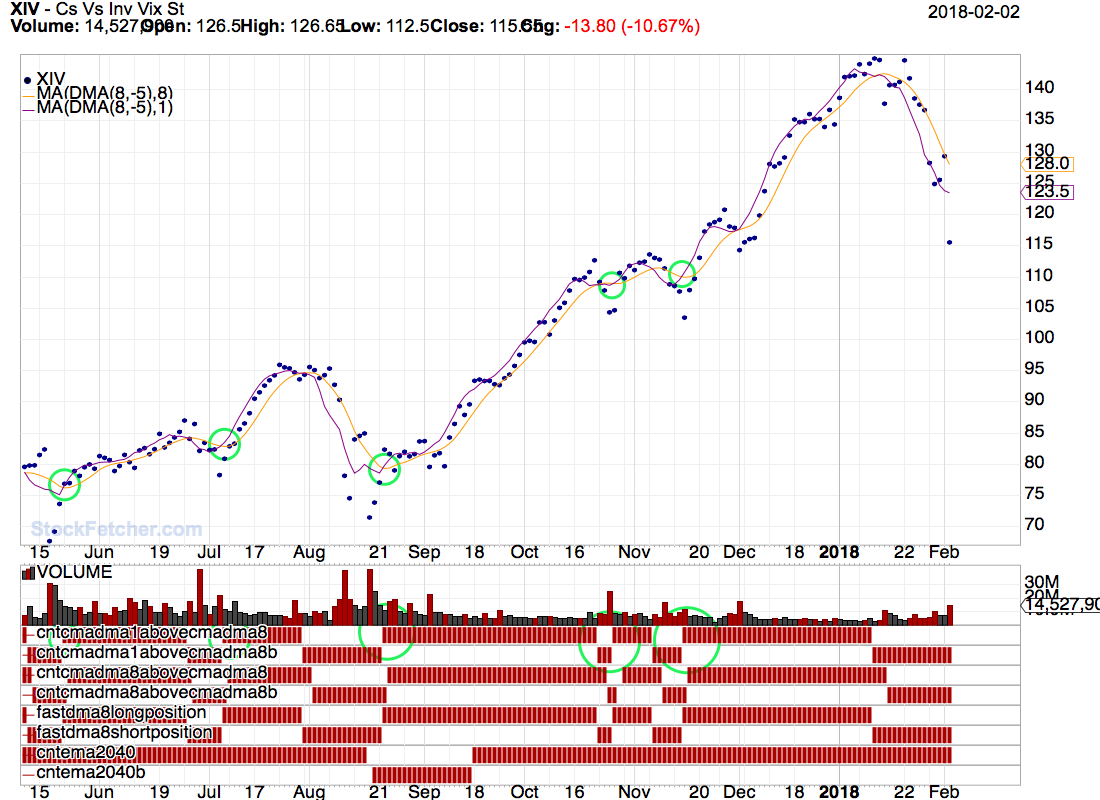

2/3/2018 1:08:58 PM and that cross could be the 97 support level. believe it or not. already lost 21% of it's value in a couple weeks. |

| Mactheriverrat 3,173 posts msg #141812 - Ignore Mactheriverrat |

2/3/2018 2:22:37 PM |

| davesaint86 726 posts msg #141814 - Ignore davesaint86 |

2/3/2018 7:16:01 PM I modified one of Kevin's Sharpe Allocation filters and embedded the code into my DMA8 filter. I do not know if it buys me anything. My goal is to find something that can get you in and out of a position faster when a trend changes abruptly. You can add whatever Bull/Inverse pair that you like to it (UGAZ/DGAZ, LABU/LABD, ZIV/VXZ, TMF/TMV, etc). I'm just playing around since I couldn't go skiing today. |

| davesaint86 726 posts msg #141815 - Ignore davesaint86 |

2/3/2018 7:20:02 PM Hedge 4-ETF Version |

| pthomas215 1,251 posts msg #141816 - Ignore pthomas215 |

2/3/2018 7:47:56 PM mac, it may stop at 105 but there is an additional support like if you go back to August...topped @ 97, then went back down to that exact level later. Just saying we may see an up day Monday but it would not surprise me if next week we dropped below 100 to 97 |

| davesaint86 726 posts msg #141822 - Ignore davesaint86 |

2/3/2018 9:16:49 PM Mac - Just noticed that you changed the code a little. Cool! |

| Mactheriverrat 3,173 posts msg #141826 - Ignore Mactheriverrat |

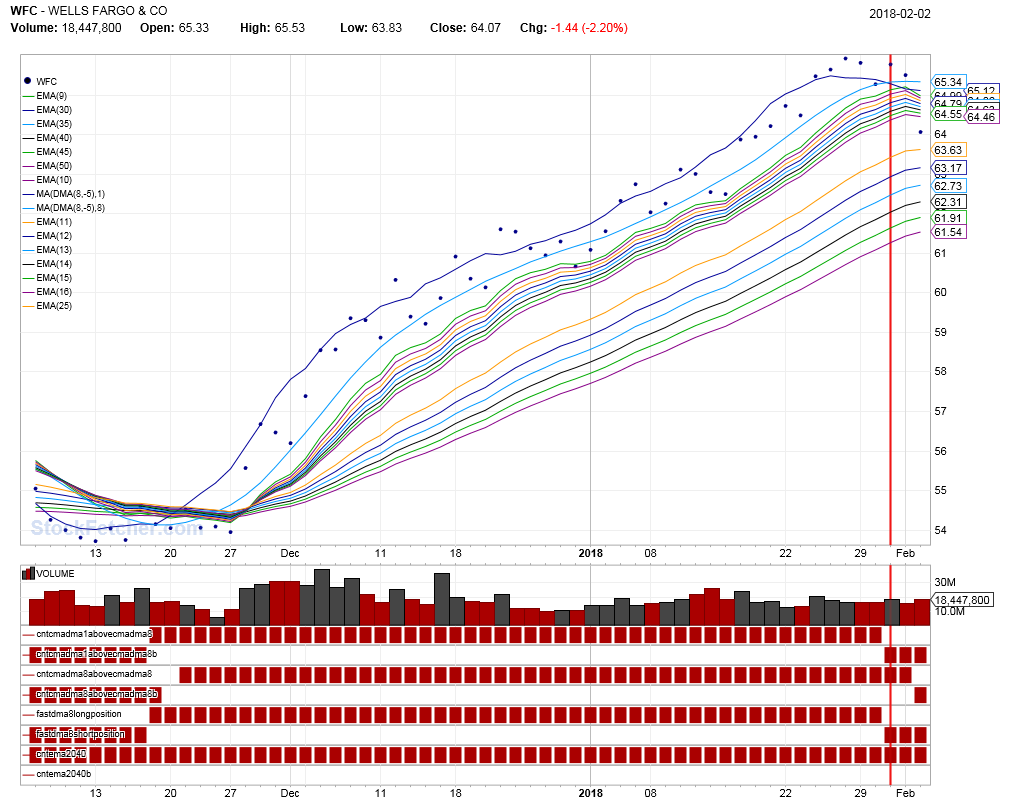

2/4/2018 1:02:51 AM @PT -Support levels are always good to watch. @Dave Roger that on the changed code cma(DMA(8,-5),1) cross above cma(DMA(8,-5),8) I've added do not draw dma(8,-5),8) but still keep watching it It seems that the cma(DMA(8,-5),1) and cma(DMA(8,-5),8) are a little slower and so far seem to be working well with each other. I just got out of WFC 2 days ago in my IRA on a cma(DMA(8,-5),1) cross below cma(DMA(8,-5),8)  |

| pthomas215 1,251 posts msg #141832 - Ignore pthomas215 |

2/4/2018 11:20:04 AM Mac/Davesaint, what is your favorite cma dma filter then that includes ""cma(DMA(8,-5),1) crossed above cma(DMA(8,-5),8)" ? |

| Cheese 1,374 posts msg #141833 - Ignore Cheese |

2/4/2018 12:08:11 PM Thank you, Mac and Dave, for sharing your very helpful filters. I have a request along the line of pthomas. May I suggest that you start a new read-only repository thread to help readers better follow your many excellent filters? e.g. MACTHERIVERRAT REPOSITORY (read-only) DAVESAINT86 REPOSITORY (read-only) Perhaps, you could also add dates to your comments inside the filters so readers can follow a little easier. Again, many thanks to both of you. |

| pthomas215 1,251 posts msg #141834 - Ignore pthomas215 |

2/4/2018 12:40:05 PM cheese, what a great suggestion. the reason is a lot of this is learning as we go, so at times it helps to have something in an organized format. different subject but same concept. I respectfully think Kevin's system is insufficient. if you opened a buy signal during the run, and then XIV suffers more than a 20% drop in value, which it did--and you dont see a corresponding sell signal with the buy signals you opened during the run up---then the system is no better than ""it is a bull market so buy more on the dip". this mentality could clear out an account if valuations drop significantly. I think Kevin's system needs to be refined to include more sell signals when xiv prices drop. Not trying to be critical--just an observation that more work on the system needs to be done. |

| StockFetcher Forums · General Discussion · XIV | << 1 ... 14 15 16 17 18 ... 22 >>Post Follow-up |