| StockFetcher Forums · General Discussion · XIV | << 1 ... 18 19 20 21 22 >>Post Follow-up |

| mahkoh 1,065 posts msg #142002 - Ignore mahkoh |

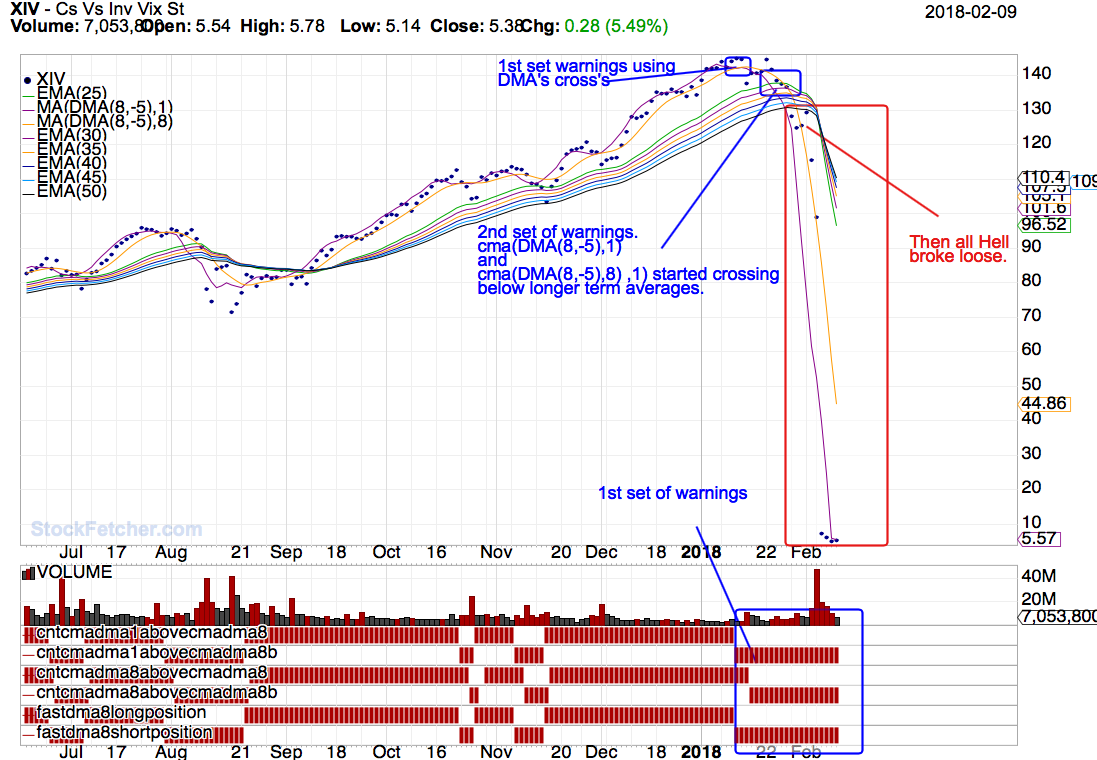

2/7/2018 2:28:54 PM In the rearview mirror it is a lot easier to see when you should have gotten out. Problem is that on previous occasions a big red candle below the longterm guppy lines proved to be an excellent opportunity to buy. |

| sandjco 648 posts msg #142007 - Ignore sandjco |

2/7/2018 7:00:51 PM this black swan event was bizarre leading to CS to terminate it. the spike was just plain weird. |

| four 5,087 posts msg #142017 - Ignore four |

2/8/2018 8:02:10 AM https://www.fool.com/investing/2018/02/06/the-simple-math-behind-the-inverse-volatility-etf.aspx |

| Mactheriverrat 3,172 posts msg #142081 - Ignore Mactheriverrat |

2/9/2018 1:14:10 PM This XIV is yesterdays news- |

| Mactheriverrat 3,172 posts msg #142123 - Ignore Mactheriverrat |

2/11/2018 3:24:08 PM |

| shillllihs 6,089 posts msg #142125 - Ignore shillllihs |

2/11/2018 4:23:54 PM But doesn’t dma keep changing so is this an accurate assertion? |

| pthomas215 1,251 posts msg #142126 - Ignore pthomas215 |

2/11/2018 4:55:07 PM yes, i think it does, just like price crossing above the ema 13 sends price action up, but it can cross over down soon after and price action will follow. i think mac's point is one of long term averages...once price action falls below those averages, long term investors are giving up on it. if i mis spoke, I apologize to you Mac. I personally think not enough attention is paid to the Beta of a stock or ETF. I was in WATT this past week, up a buck. damn thing plummeted 1.50 in 2 minutes. i checked the Beta after....hmmm, makes sense now. a Beta over 1.5 is more profitable but more dangerous. |

| StockFetcher Forums · General Discussion · XIV | << 1 ... 18 19 20 21 22 >>Post Follow-up |